Bitcoin the creation of Satoshi Nakamoto has been a key fact in the modern world.

He might never think that his creation will be a world-changing concept. In a time period when money is only used in the physical transaction methods, he created the digital currency method.

So now in 2022 after 13 years of Bitcoin creation, digital currency is a pioneered by Bitcoin. That’s how important it is now. Thousands of Market experts and market scientists always keep eye on this Cryptocurrency market because it’s so important to the world economy.

So now let’s get into the topic. Just a reminder, all the predictions made here, are based on market news, data, and analysis. So every reader is advised to do their own research before making any decisions.

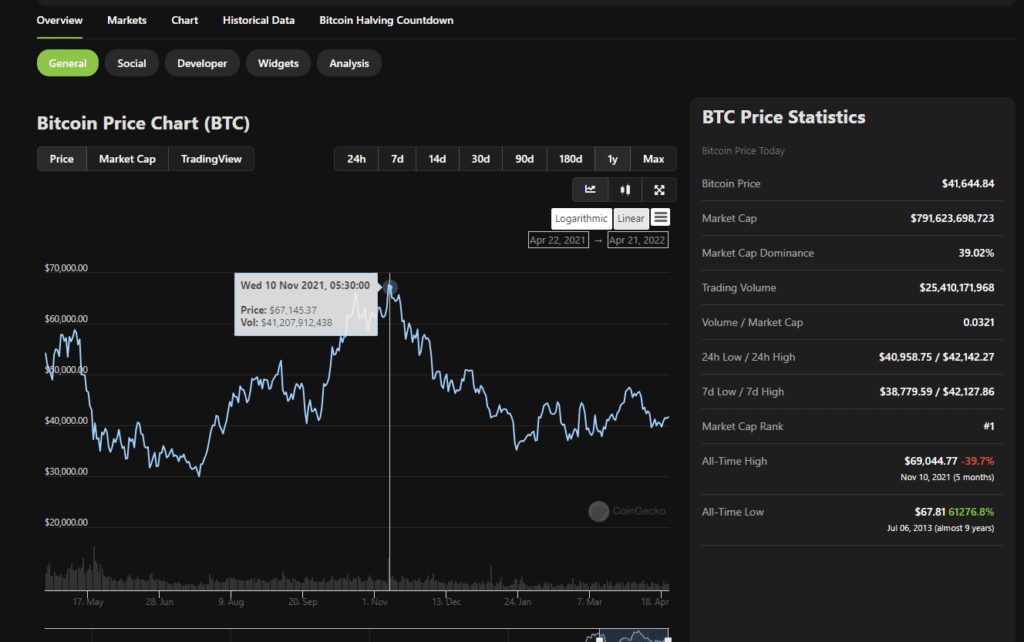

2020 and 2021 were the golden years for Cryptocurrency. Most Altcoins had their all-time high in this two-year time period. Even Bitcoin had its all-time high last year which was valued at $68,789.63 according to Coinmarketcap.com.

However, from the beginning of 2022, it was a very bad nightmare for cryptocurrency users. So with many fundamental reasons market collapsed and as same as fundamental reasons marked turned in to the green.

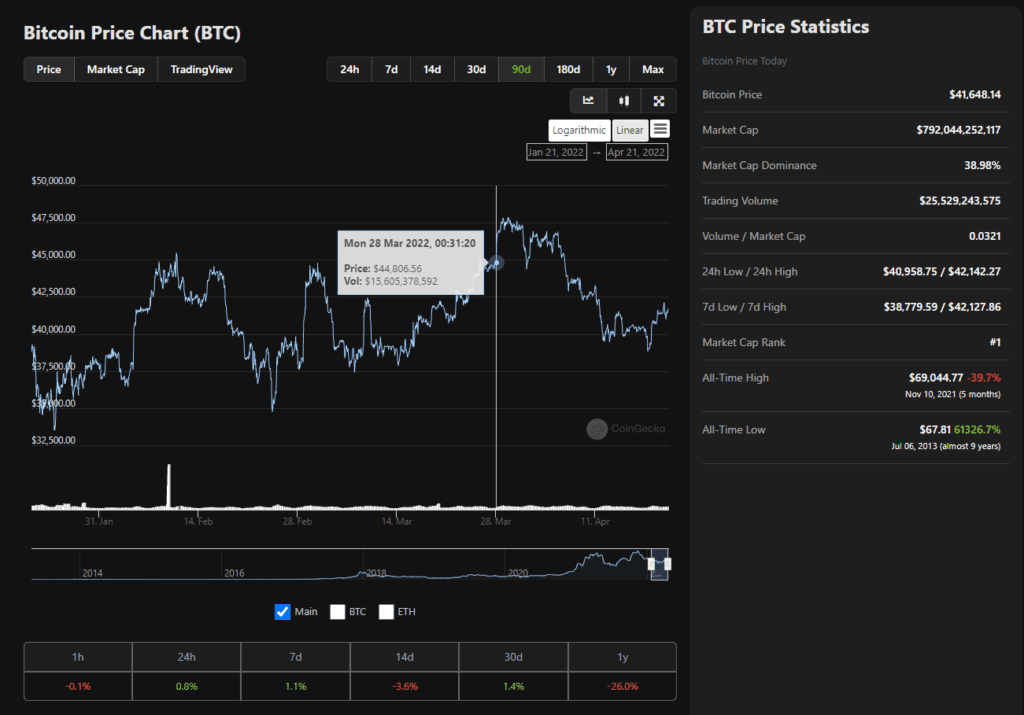

Last two months Cryptocurrency market is unstable as it was reaching the $35,000 mark and in the same week, the market reached $45,000. It was highly Volatile.

In the expert’s view market has been significantly stable recently, despite there being many fundamental reasons which maybe affect the market in bad ways.

Bitcoin is the King of Cryptocurrency with a $786 Billion market capitalization. Following that Ethereum is the second-largest cryptocurrency with a whopping $370 Billion market capitalization. So if Bitcoin has the green light most of the altcoins trade in green bullish mode or if Bitcoin is in red candle most of the altcoins will be bearish.

Last 14 days Market was down 11%. Monday, April 18 Bitcoin dropped to the $38,880 mark. Somehow yesterday market was able to recover 3.2%. After losing the $40,000 mark significantly now the market is recovering back.

So technically you can see the market is still in a middle unpredictable position. If it will be able to break the resistance level it may end up at an all-time high price as well as if it was able to reach the support level it may end up again at the $30,000 mark. Still, it is in a middle position where the market can slide to any side.

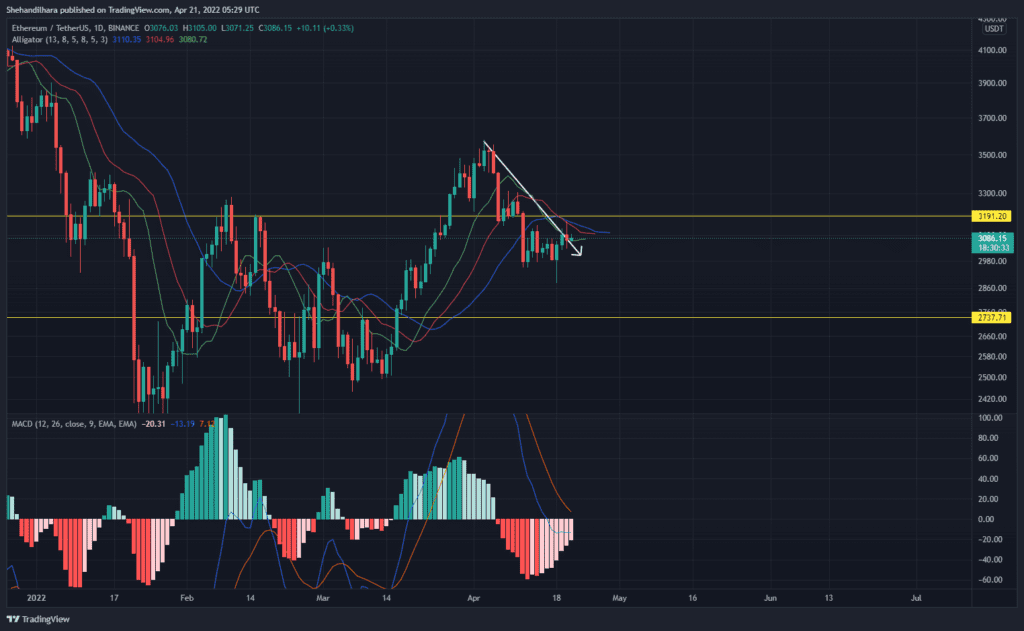

So let’s have a look at Ethereum. It also has the same issue. For the last two weeks market was trying to break the resistance level. But you can clearly see from the resistance level market has slid down again. It seems like the market will need more power to break the barriers.

Especially you can see the market is rotating between these support and resistance levels. After touching the top resistance market has come down again to the support level and again after touching the support level market has changed its direction to the resistance level

Technically you can see the market is still in an unpredictable move. This is just a simple prediction that anyone can easily understand.

Both Bitcoin and Ethereum markets are still trying to break their barriers at the same time both the markets are touching support and resistance in a significant manner.

Following that, we know despite technical analysis fundamentals are the most important thing. Mainly past days the Russian Ukraine war was stopped for a break.

. Mainly past days the Russian Ukraine war was stopped for a break. But after Ukraine attacked a Russian Warship the war started again. After Russia attacked Kyiv, hours later the cryptocurrency market started to fall. So until the War continues we cannot expect a big gain inside the market.

As well as US dollar Currency Index ( DXY) hits a 52-week high of 101.04 and also affected the market.US dollar currency index means (USDX) as a measure of the value of the U.S. dollar relative to a basket of foreign currencies. So historically this US dollar currency index and Bitcoin (Cryptocurrency market) and the Gold market is always connected.

With the US dollar, those other two markets always have an inverse trend. It always happens consistently. When US Dollar gains momentum Bitcoin underperforms.

After that, we had the Tax day in the US. April 18 last Monday was the deadline for most taxpayers in the US to file their returns.

As well this Month Bitcoin collapsed again because the US Federal Reserves released policy meetings from March 15-16 which means to Central bank to reduce its balance sheet and raise interest rates.

Market Volatility is also a bad index that causes market prices up-down. On April 11 a cryptocurrency tracker named Whale Alert reported a transfer of 5,100 BTC from an unknown wallet address to Coinbase.

So at that time, the value of those 5,100 Bitcoins was $210,943,265. After 4 hours later the same transaction happened the other way 5,100 BTC from Coinbase to an unknown wallet. So it seems like Crypto whales are looking for something as those large number of movements may affect the market.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 5,100 #BTC (210,943,268 USD) transferred from unknown wallet to #Coinbasehttps://t.co/NUmK4gDm41

— Whale Alert (@whale_alert) April 11, 2022

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 5,100 #BTC (206,822,775 USD) transferred from #Coinbase to unknown wallethttps://t.co/31vidz6Y3R

— Whale Alert (@whale_alert) April 11, 2022

So all the readers make sure to do your own analysis before doing anything in the Cryptocurrency market.