Key Takeaways

- What is blockchain?

- Is Blockchain Safe?

- How is Blockchain Used?

- Advantages and Disadvantages of Blockchain

For the past few years, you’ve heard the term “blockchain technology” consistently, probably concerning cryptocurrencies like bitcoin. It seems that blockchain is commonplace, but in a hypothetical sense as there is no real meaning that the layman can easily understand. Understanding what blockchain is, what technology is used, how it works, and how it is vital in the digital world is important.

According to Global Data’s thematic research report, the demand for cryptocurrencies in 2018 has decreased by 20% compared to previous years as companies prefer to implement traditional approaches to their projects in earlier stages rather than using blockchain technology.

What is blockchain? First and foremost, Blockchain is a public electronic ledger. This is the Simple definition and let’s look deeper into what is blockchain?

A blockchain is essentially a digital ledger of transactions that is duplicated and distributed across the entire network of computer systems on the blockchain. Each block in the chain contains several transactions, each time a new

occurs. Transaction on the blockchain, a record of this transaction is added to the general ledger of each participant.

A block in a chain was changed, it would be immediately apparent that it had been tampered with. If hackers wanted to damage a blockchain system, they had to change every block in the chain in all distributed versions of the chain. Bitcoin and Ethereum grow steadily and continuously as blocks are added to the chain, which greatly increases the security of the ledger.

Blockchain seems complicated, and it definitely can be, but its core concept is quite simple. A blockchain is a type of database. To understand blockchain, it is helpful first to understand what a database is.

A database is a collection of information that is electronically stored on a computer system. The information or data in databases is generally structured in a tabular format to make it easier to find and filter specific information. What is the difference between someone using a table to store information instead of a database?

A key difference between a typical database and a blockchain is the way the data is structured. A blockchain gathers information in groups, also known as blocks, that contain sets of information. Blocks have certain storage functions and, when filled, are chained together to form a chain of data known as a “blockchain”. Any new information that follows this newly added block will be compiled into a newly formed block which will also be added to the chain when completed.

A database structures your data in tables, while a blockchain, as the name suggests, structures your data in chunks (blocks) that are chained together. This makes all blockchains databases, but not all databases, blockchains. This system also inherently creates an irreversible timeline of data when implemented remotely. When a block is full, it is set in stone and becomes part of that timeline. Each block in the chain is assigned an accurate timestamp when it is added to the chain.

To understand blockchain, it is instructive to view it in the context of implementing Bitcoin. Like a database, Bitcoin requires a collection of computers to store its blockchain. For Bitcoin, this blockchain is just a certain type. In the case of Bitcoin, and unlike most databases, these computers are not all under one roof, and each computer or group of computers is operated by a unique person or group of people. It has a server with 10,000 computers and a database that contains all the information on its customers’ accounts.

This company has a warehouse that brings all of these computers under one roof and has complete control over each of these computers and all the information they contain. Bitcoin is made up of thousands of computers, but each computer or group of computers that contains its blockchain is in a different geographic location and is all operated. These computers that make up the Bitcoin network are called nodes.

In this model, the Bitcoin blockchain is used decentrally. Private and centralized blockchains, which contain computers that make up your network and are operated by a single entity, do exist. In a blockchain, each node has a full record of the data that has been stored on the blockchain since it was first introduced.

With Bitcoin, the data is the complete history of all Bitcoin transactions. If a node has an error in its data, it can use the thousands of other nodes as a benchmark to correct itself. In this way, no node on the network can change the information it contains. Because of this, the transaction history in each block that makes up the Bitcoin blockchain is irreversible.

If the user tampered with the Bitcoin transaction log, all other nodes would reference each other and easily refer to the node with the wrong information. This system helps to establish an exact and transparent sequence of events. In Bitcoin, this information is a list of transactions. However, it is also possible that a blockchain contains a large amount of information, e.g. B. Legal contracts, government IDs, or a company’s product inventory. Stored in it, most of the computing power in the decentralized network would have to agree to such changes to ensure that any changes that occur are in the majority’s best interests.

Due to the decentralization of the Bitcoin blockchain, all transactions can be viewed transparently by either having a personal node or using blockchain explorers that allow anyone to view transactions live. Each node has its copy of the chain that is updated as new blocks. They are confirmed and added. This means you can track Bitcoin anywhere if you want. For example, exchanges have been hacked in the past where those who had Bitcoin on the exchange lost everything. While the hacker may be completely anonymous, the bitcoins they mined are easily traceable. If the bitcoins stolen in some of these tricks were moved or spent somewhere, it would be known.

Is Blockchain Safe?

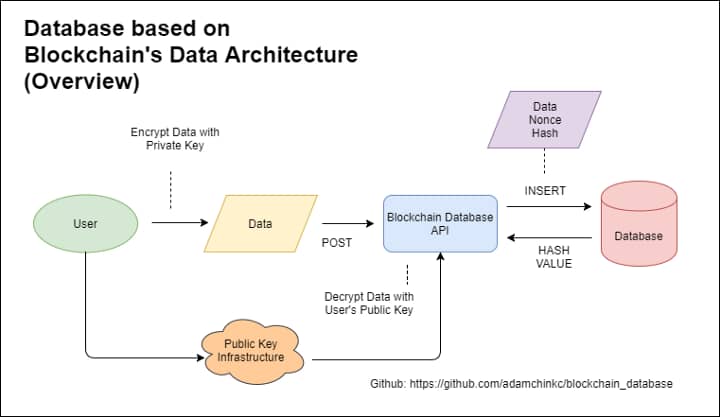

Blockchain technology creates a data structure with inherent security qualities. It is based on principles of cryptography, decentralization, and consensus, which guarantee trust in transactions. In most blockchains or distributed ledger technologies (DLT), data is structured in blocks and each block contains a transaction or a package of transactions.

Each new block creates a connection to all blocks in front of it in a cryptographic chain, so that manipulation is almost impossible. All transactions within the blocks are validated, and they agree through a consensus mechanism that guarantees that every transaction is true and correct. Blockchain technology enables decentralization through the participation of members over a distributed network. There is no single point of failure and no single user can change the transaction log. However, blockchain technologies differ in some critical security aspects.

Blockchain technology addresses security and trust issues in several ways. First, new blocks are always stored linearly and chronologically. That is, they are always added to the “end” of the blockchain. You will see that each block has a position in the string called the “height”. By November 2020, the height of the block had so far reached 656,197 blocks.

After a block is added to the end of the blockchain, it is very difficult to go back and change the contents of the block unless the majority reaches a consensus on it. This is because each block has its hash along with the hash of the previous block as well as the timestamp mentioned above. Hash codes are created by a mathematical function that converts digital information into a sequence of numbers and letters. If this information is manipulated in any way, the hash code will also change. That is why it is important for safety. Let’s say a hacker wants to manipulate the blockchain and steal bitcoin

from everyone else. If they changed their unique copy, it would no longer match everyone else’s copy. If everyone else was comparing their copies, they would. Make sure this copy gets noticed and that the hacked version of the chain is dismissed as improper. To be successful with such a hack, the hacker would have to control and modify 51% of the blockchain copies at the same time, so that his new copy becomes the majority copy and thus the agreed chain. This attack would also require an immense amount of money and resources.

You would have to repeat all the blocks as they would now have different timestamps and hash codes. Network and how fast it grows, the cost of such performance would likely be insurmountable.

Not only would it be extremely expensive, it would also likely be fruitless. Since members of the network would see such drastic disruptions in the blockchain, members of the network would switch to a new version of the chain that is not affected, which would cause the attacked version of Bitcoin to depreciate, ultimately rendering the attack useless as the bad actor is in control of a useless asset. The same would happen if the bad actor attacked the new bitcoin fork built this way, so participating in the network is much more economical than attacking.

Blockchain networks can differ in who can participate and who has access to the data. Networks are generally marked as public or private, which describes who can participate, and with or without permission, which describes how participants can access the network. And private blockchains Public blockchain networks generally allow anyone to become a member, and participants remain anonymous.

A public blockchain uses computers connected to the internet to validate transactions and reach consensus. Bitcoin is probably the best-known example of a public blockchain and is reaching a consensus. Through “Bitcoin Mining”.

Computers on the Bitcoin network, or “miners”, attempt to solve a complex cryptographic problem to produce proof of work to validate the transaction. Outside public keys, there are few identities and access controls in this type of network. Identity to confirm membership and gain access rights and usually only allow known organizations to join.

Together, the organizations form a private corporate network for members only.” A private blockchain on an authoritative network achieves consensus through a process called ‘selective backup’ in which transactions are verified by known users. Only members with specific access and permissions can manage the transaction ledger.

This type of network requires more identity — and access controls. When building a blockchain application, it is important to assess which type of network will best suit your business goals. Private and licensed networks may be tightly controlled and preferable for compliance reasons. Public and unlicensed networks, however, can be more decentralized and preferred to Achieve distribution.

Key Elements of a Blockchain

- Distributed ledger technology

All network participants have access to the distributed general ledger and its unchangeable transaction record. With this common ledger, transactions are recorded only once, avoiding the duplication of work that is typical of traditional corporate networks.

- Immutable records

No participant can change or edit a transaction after it has been posted to the shared general ledger. If a transaction record contains an error, a new transaction must be added to reverse the error and both transactions will be visible.

- Smart contracts

To speed up transactions, a series of rules called a smart contract is stored on the blockchain and executed automatically. A smart contract can define the terms for the transfer of corporate bonds, terms for the payment of travel insurance, and much more.

How is Blockchain Used?

As we now know, the blocks in the Bitcoin blockchain store data about monetary transactions, but it turns out that the blockchain is a reliable way to store data about other types of transactions as well. Some companies that have already integrated the blockchain are Walmart, Pfizer, etc. AIG, Siemens, Unilever and many others

For example, IBM created its Blockchain Food Trust1 to track the route food products take to reach their locations. Cold, salmonella, listeria, and dangerous substances are accidentally introduced into the food. In the past, it took weeks to find the cause of these outbreaks or the cause of illness from what people eat. Track a food product from its source, through each stop, to delivery. If food is found to be contaminated, each stop can be used to trace it back to its source.

Exactly that, but these companies can now also see everything else they came in contact with, so problem identification can come much sooner and potentially save lives. This is an example of blockchain in practice, but there are many other ways to implement blockchain.

Blockchain benefits in Banking and Financial

When financial institutions replace old processes and paperwork with blockchain, the benefits include eliminating frictions and delays, and increasing operational efficiencies across the industry, including world trade, trade finance, clearing and settlement, bank, consumption, credit, and other transactions

Perhaps no industry will benefit more from blockchain integration into their business operations than banking. Financial institutions only work five days a week during business hours. So if you try to deposit a check at 6:00 p.m. on Friday, you will likely have to wait until Monday morning to make sure the money is in your account.

Even if you are making your deposit during business hours, the transaction review may take one to three days due to the large volume of transactions that banks have to liquidate. On the other hand, it never sleeps. By integrating the blockchain with banks, consumers can see that their transactions are processed in just 10 minutes. This is the time it takes to add a block to the blockchain, regardless of holidays or times of the day. Or week. With blockchain, banks also have the option of exchanging money between institutions faster and more securely.

For example, in the stock trading business, the settlement and clearing process can take up to three to four days (or longer if traded internationally), which means money and stocks are frozen for that period several, the few days that money is on the move can be significant to Bring costs and risks for the banks. . European bank Santander and its research partners estimate the potential savings of between $15 billion and $20

billion per year. 3 Capgemini, a French consultancy, estimates that blockchain-based applications allow consumers to invest up to $16 billion in banking every year, And save insurance fees through blockchain-based applications.

Blockchain Benefits in Currency

Blockchain forms the basis for cryptocurrencies such as Bitcoin. The US dollar is controlled by the Federal Reserve. With this central system of authority, a user’s data and currency technically correspond to the whims of their bank or government. When a user’s bank is hacked, the customer’s private information is compromised. If the customer’s bank breaks down, or they live in a country with an unstable government, the value of their currency can be at risk.

In 2008, some of the banks that ran out of money were partially bailed out with taxpayers’ money. These are the concerns that Bitcoin was first designed and developed out of. By expanding operations over a computer network, the blockchain enables Bitcoin and other cryptocurrencies to be operated without the need for a central authority. This not only reduces risk but also eliminates many of the processing and transaction fees.

It can also give those in countries with unstable currencies or financial infrastructures a more stable currency with more applications and a wider network of people and institutions to do business with both domestically and internationally.

The payment is especially high for those who do not have government identification. Some countries may have been ravaged by war or have governments that lack real infrastructure for identification. Citizens of these countries may not have access to savings or brokerage accounts and therefore there is no way to keep assets safe.

Blockchain Benefits in Healthcare

In an industry troubled by data breaches, blockchain can help healthcare improve security for patient data while making it easier to share records across providers, payers, and researchers. Control over access remains in the hands of the patient, increasing trust.

Healthcare providers can use the blockchain to securely store their patients’ medical records. When a medical record is created and signed, it can be written to the blockchain to provide evidence to patients and have confidence that the registry cannot be changed. The records can be encrypted and stored in the blockchain with a private key so that only certain people can access them to ensure privacy.

Blockchain Benefits in Records of Property

f you’ve ever spent time at the local registry office, you know that the process of registering property rights is both burdensome and ineffective. Today, a physical deed must be given to a government employee at the local registry office, where it is manually entered into the county’s central database and public index. In the event of a property dispute, property claims must be matched against the public index. Not only is this process costly and time-consuming, but it is also subject to human error, where any inaccuracy will make property tracking less efficient.

Blockchain has the potential to eliminate the need to scan documents and track physical files in a local registration office. When ownership is stored and verified on the blockchain, owners can be confident that what they did is correct.

In war-torn countries or areas with little or no government or financial infrastructure, and certainly without a “Registrar’s Office”, it may almost be impossible to prove ownership of a property. If a group of people living in such an area can use the blockchain, transparent and clear deadlines could be set for ownership of the property.

Blockchain with Smart Contracts

A smart contract is a computer code that can be integrated into the blockchain to facilitate, review, or negotiate a contractual agreement. Smart contracts run under a number of conditions that users agree to. When these conditions are met, the terms of the agreement apply. For example, let’s say a potential tenant wants to rent an apartment with a smart contract.

The landlord undertakes to give the tenant the code of the apartment door as soon as the tenant pays the deposit. The landlord would send their respective parts of the business to the smart contract, which will automatically manage the door code at the time of rental start and exchange it for the deposit. The smart contract reimburses the security deposit, eliminating the fees and processes normally associated with using a notary, outside intermediary, or attorney.

Blockchain Benefits in Supply Chains

As in the IBM Food Trust example, vendors can use the blockchain to record the origin of the materials they buy. This would enable companies to verify the authenticity of their products using common labels such as “organic”, “local” and “fair trade”. As Forbes reported, the food industry is increasingly turning to the use of blockchain to track the path and safety of food on its way from the farm to the user.

Building trust between trading partners, providing end-to-end transparency, simplifying processes, and solving problems faster with blockchain all contribute to a stronger, more resilient supply chain and better business relationships, and participants can act faster in the event of disruptions. In the food industry, blockchain can help ensure food safety and freshness and reduce waste. In the event of contamination, food can be traced back to its source in seconds instead of days.

Advantages and Disadvantages of Blockchain

Despite all the complexity, the potential of the blockchain as a decentralized form of recording is almost unlimited. From increased user privacy and increased security to lower processing fees and fewer errors, blockchain technology can see applications beyond those described above. There are some downsides too.

- Advantages of Blockchain

Cost Reductions

Consumers typically pay a bank to review a transaction, a notary to sign a document, or a minister to celebrate a marriage. Blockchain eliminates the need for third-party verification and the associated costs. Entrepreneurs pay a small fee. Whenever they accept credit card payments, for example, because banks and payment processing companies need to process these transactions. Bitcoin, on the other hand, has no central authority and only limited transaction fees.

Private Transactions

Many blockchain networks work as public databases. This means anyone with an internet connection can see a list of the network’s transaction history. Although users can access transaction details, they cannot access identifying information about the users who are performing those transactions. It’s a common misperception.

That blockchain networks like Bitcoin are anonymous when in reality they are just confidential, i.e. when a user is making public transactions, their unique code, known as the public key, is recorded on the blockchain and not their personal information. If you’ve bought bitcoin on an exchange that requires identification, the person’s identity will still be linked to their blockchain address. However, a transaction, even if linked to a person’s name, does not reveal any personal information.

Transparency

Most blockchains are completely open-source software. This means that everyone can see their code. This allows auditors to check cryptocurrencies such as Bitcoin for security. This also means that there is no authority over who controls the Bitcoin code or how it controls it. For this reason, anyone can suggest changes or updates to the system. If the majority of network users think that the new version of the code with the update is solid and meaningful, then Bitcoin can be updated.

Banking transactions without bank details

Perhaps the deepest facet of blockchain and bitcoin is the ability of everyone, regardless of their ethnicity, gender, or cultural background to use them. According to the World Bank, there are nearly 2 billion adults who do not have bank accounts or the means to store their money or assets.5 Almost all of these people live in developing economies, where the economies are still in their infancy and are completely dependent on them depending on the cash register. These people often make little money that is paid for in cash.

Cash in hidden places in their homes or in places in life where they are exposed to theft or unnecessary violence. Keys to a Bitcoin wallet can be memorized on a piece of paper, a cheap cell phone, or even if necessary. These options are probably easier to hide than a small pile of cash under a mattress. The blockchains of the future are also looking for solutions to not only be a unit of account for storing wealth, but also to store legal records, property rights, and a variety of other legal contracts

Safe transactions

Once a transaction has been recorded, its authenticity must be verified by the blockchain network. Thousands of computers on the blockchain are rushing to confirm that the purchase details are correct. Once a computer has validated the transaction, it is added to the blockchain. Each block in the blockchain contains its own unique hash as well as the unique hash of the previous block. If the information in a block is manipulated in any way, the hash code for that block changes. The hash code of the back block Now This discrepancy makes it extremely difficult to change information on the blockchain without notice.

Decentralization

Blockchain does not store any of your information in a central location. Instead, the blockchain is copied and distributed over a computer network. Every time a new block is added to the blockchain, every computer on the network updates its blockchain to reflect the change. Disseminating this information over a network instead of storing it in a central database makes the blockchain more difficult to manipulate. If a copy of the blockchain falls into the hands of a hacker, only a copy of the information and not the entire network would be compromised.

Quick and Efficient Transaction

Transactions made through a central authority can take up to a few days. For example, if you try to deposit a check on Friday night, your balance may not show up in your account until Monday morning. Blockchain works five days a week, 24 hours a day, seven days a week, and 365 days a year. Transactions can be completed in just ten minutes and are considered secure after a few hours. This is particularly useful for cross—border transactions, which tend to take much longer due to time zone issues and the fact that all parties have to confirm payment processing.

Disadvantages of Blockchain

While blockchain offers significant advantages, its introduction also poses significant challenges. The obstacles to the application of blockchain technology today are not only technical in nature. The real challenges are largely political and regulatory. Here are some of the challenges that stand in the way of adoption

Speed inefficiency

Bitcoin is a perfect case study for potential blockchain inefficiencies. Bitcoin’s “Proof of Work” system takes about ten minutes to add a new block to the blockchain. At this rate, it is estimated that the blockchain network can only process around seven transactions per second (TPS). While other cryptocurrencies like Ethereum perform better than Bitcoin, they are still constrained by the

blockchain. The legacy Visa brand can be processed in the context of 24,000 TPS. Solutions to this problem have been developed for years. There are currently blockchains. That has more than 30,000 transactions per second.

Storage

Blockchain ledgers can grow rapidly over time. The Bitcoin blockchain currently requires around 200 GB of storage space. The current growth in blockchain size seems to outpace the growth of hard drives, and the network is at risk of losing nodes if the ledger grows too big to do so. Download and save.

Illegal Activity, Attacks

While confidentiality on the blockchain network protects users from attacks and protects privacy, it also enables illegal trade and activities on the blockchain network. Probably the most cited example of using blockchain for illegal transactions is the Silk Road, an online “dark web”. Drug market that operated from February 2011 to October 2013 when it was closed by the FBI.6 The website allowed users to browse the website without being tracked with the Tor browser and allow illegal purchases in Bitcoin or other cryptocurrencies make.

Financial services providers obtain information about their customers when they open an account, verify the identity of each customer, and confirm that customers are not on a list of known or suspected terrorist organizations. It gives anyone access to financial accounts, but it also allows criminals to conduct transactions more easily. Many have argued that good use of PTO wines, much like banking in the no-banking world, outweighs crypto abuse, especially when most of the illegal activities are still being carried out with untraceable money.

The consensus proof of work algorithm that protects the Bitcoin blockchain has proven to be very efficient over the years. However, there are some potential attacks that can be carried out against blockchain networks and 51% of the attacks are among the most talked about.

This happens when an entity manages to control more than 50% of the network’s hashing power, potentially disrupting the network by deliberately excluding or changing the order of transactions. Although this is theoretically possible, there has never been a successful 51% attack on the Bitcoin blockchain network.

As the network grows, security increases and miners are quite unlikely to invest a lot of money and resources to attack Bitcoin as they will be better rewarded for trading, honestly. That being said, a 51% successful attack could only change recent transactions for a short period of time because the blocks are linked by cryptographic evidence (changing older blocks would require intangible processing power). Bitcoin’s blockchain is very resilient and would adapt quickly in response to an attack.

Private keys and Regulation

Blockchain uses public-key cryptography (or asymmetric cryptography) to give users ownership of their cryptocurrency units (or other blockchain data). Each blockchain address has a corresponding private key. While the address can be shared, the private key must be kept secret. Users need their private keys to access their money. This means that they act as their own bank. If a user loses their private key, the money is effectively lost and there is nothing they can do about it.

Many in the crypto space have raised concerns about government regulation of cryptocurrencies. While it becomes increasingly difficult and nearly impossible to quit something like Bitcoin as its decentralized network grows, governments could theoretically ban ownership of cryptocurrencies or join their networks. Over time, this problem has lessened as large companies like PayPal begin to allow the ownership and use of cryptocurrencies on their platform.

Blockchain was first proposed as a research project in 1991 and sits comfortably in your late twenties. Like most millennials of his age, blockchain has come under public scrutiny over the past two decades, with companies from all walks of life speculating on what technology is.

With many practical applications for the technology already implemented and researched, blockchain is finally making a name for itself at the age of 27, mainly due to Bitcoin and cryptocurrencies. Blockchain is a buzzword in the language of every investor in the nation, making business and government operations more accurate, efficient, secure, and cost-effective with fewer middlemen.