On one hand, Cardano’s Vasil difficult fork has been delayed but again. On the other hand, its native token ADA charge has rallied, further flipping Ripple’s XRP to become the 7th biggest cryptocurrency in the world via market value. However, information speculates that ADA is nearing a steep correction.

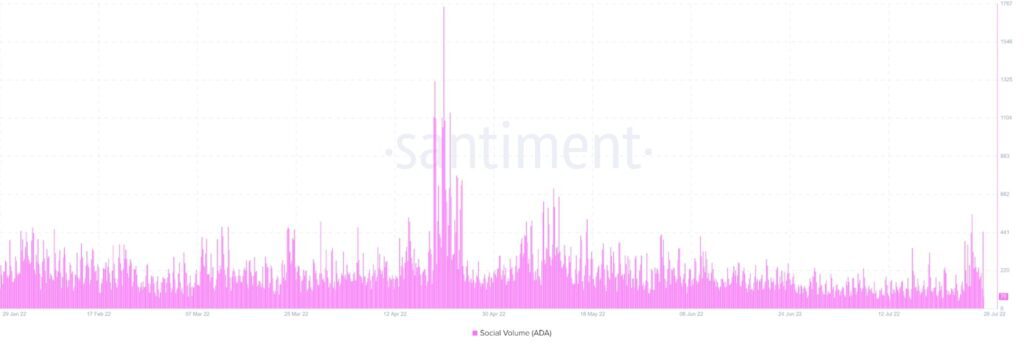

According to ADA’s social quantity metrics from the on-chain and social metrics firm, Santiment — the price rally is justified given the excessive social sentiment, as the chart indicates social recovery.

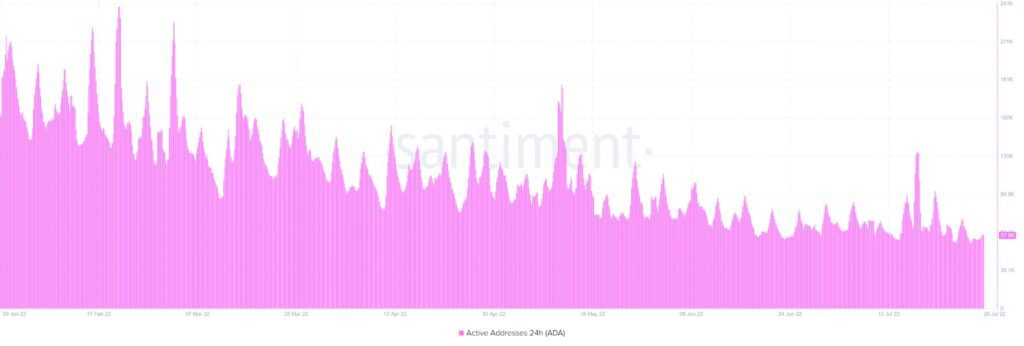

Meanwhile, vigorous addresses carry a contrasting narrative and may also additionally assert that social quantity is excessive due to synthetic hype on neighborhood platforms. Given that ADA’s full-of-life addresses are nevertheless substantially low, while the social extent stays high, there are excessive chances of charge correction.

Cardano Facing Hype/FUD Volatility

Earlier this month, when poor sentiment from the crypto regional used to be extremely good for Cardano, Watcher Guru analyzed Cardano’s social sentiment charts, concluding a plausible bull run.

According to Santiment, – Cardano’s price used be down through using almost 70% this year, in addition to triggering a horrible social sentiment closer to the crypto. Nevertheless, the employer highlighted that at some point in the final time the crowd used to be this horrible in January, “ADA rebounded +24% in 5 days until sentiment grew to become fine again”.

🥲 #Cardano's price is down 69% in 2022, and this has caused social sentiment toward the #8 market cap asset to drop harder than most. The last time the crowd was this negative in Jan, $ADA rebounded +24% in 5 days until sentiment turned positive again. https://t.co/4BLpLNDraG pic.twitter.com/mJgnhtpB1V

— Santiment (@santimentfeed) July 13, 2022

Simplistically, a bad examination completely ascertains that more holders will incur losses if they presented the cryptocurrency at the prevailing price. In mild of this, it can additionally be deciphered that an investor usually sells for earnings and buys for the period of the dip, in addition to finding out that Cardano’s charge used to be doubtlessly in a pinnacle feature to make a hasty restoration as holders, especially whales need to take reap of the minimize charge stages to fill their bags. However, the cutting-edge metrics may additionally speculate that Cardano’s cost is going thru decreased returned and forth volatility amid the ongoing FUD and Hype on social media platforms.